Shamrock Trading Corporation, Flagged Invoices

2021

Shamrock Trading Corporation is a parent company for transportation, finance, and technology services. One of the financial services Shamrock offers is factoring, which means Shamrock will buy invoices from truck drivers so they get paid in 1-2 days instead of the typical 60-90 days from the company they hauled for. These invoices must be audited by Shamrock account representatives before purchasing.

During invoice audits, reps will sometimes flag an invoice, signifying it cannot be purchased due to an issue. For example, if an invoice has bad quality documents attached or is missing certain documents it would be flagged. The current process is very manual and requires the reps to reach out to the customer to explain the issue and try to resolve it.

Project goals

Process

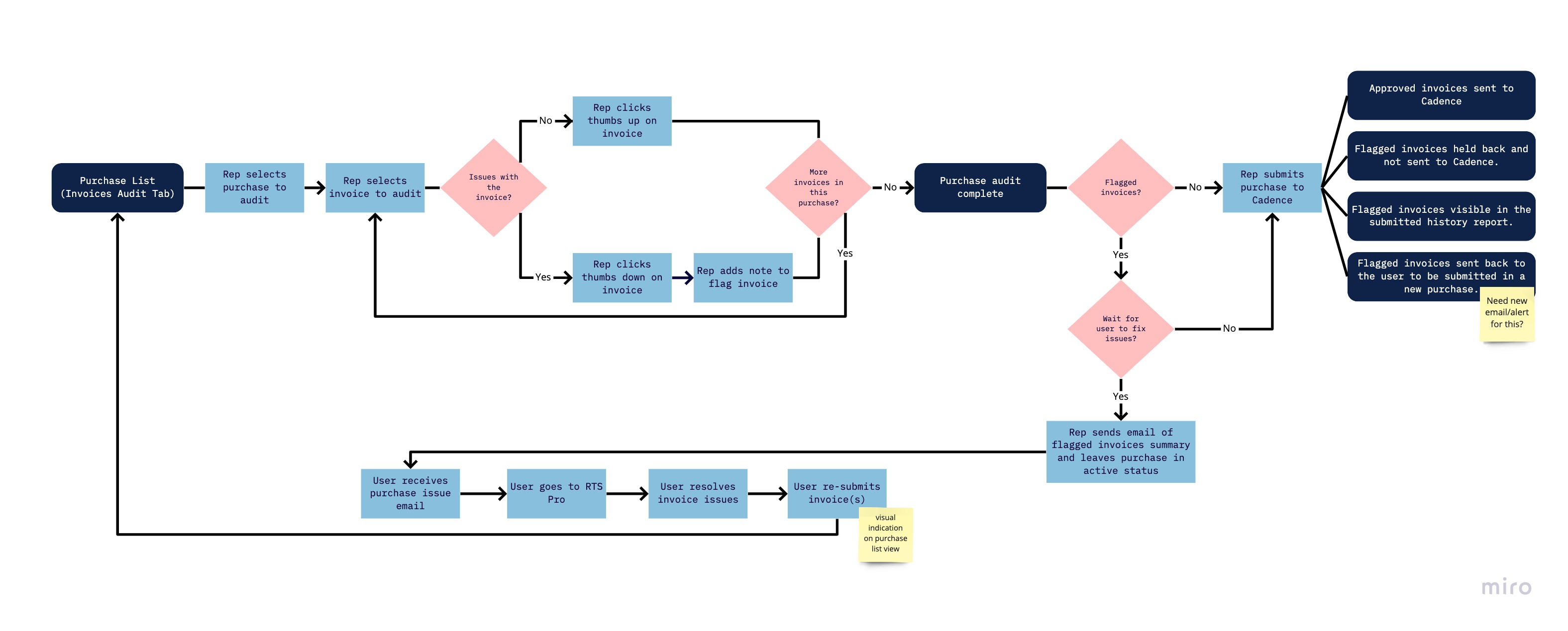

To begin this process, we had a kickoff meeting with the product squad and business stakeholders to review project goals, discuss the current process, and brainstorm on initial requirements. After the meeting, I created a Miro board outlining the user flow, decision points, and functionality to ensure all parties were on the same page and approved of the path forward.

![]()

Not all customer account teams handle audits the same way, making the initial scope of this project more complicated. Depending on the customer, auditors will either allow time for fixes or just flag the invoice and move on to the next audit. Larger customers that submit a high volume of invoices (and generate significant revenue) are usually given the chance to fix issues before auditors submit their purchase for funding. Smaller customers do not get that opportunity and have to create a new invoice submission to be re-audited and (hopefully) funded.

Therefore, we had two user flows branching off from the internal audit process:

After reviewing the flows with the UX team, I started to wonder whether we were overcomplicating the current same-day processing flow and unnecessarily duplicating functionality in the app.

The Product Owner ultimately agreed and mentioned that larger customers probably won’t change their behavior and will expect to still go through their rep to fix issues. We worried this would be wasted functionality as the immediate value was in making it easier for smaller customers (often doing business on their phones) to resubmit flagged invoices.

We regrouped with the business stakeholders to vet this decision as well. They agreed and we discussed what terminology reps use with customers to communicate flagged invoices. We learned:

After these discussions, we refocused our efforts on the mobile experience for smaller customers who would need to resubmit their invoices.

I conducted some mobile competitive analysis and sketched some initial concepts.

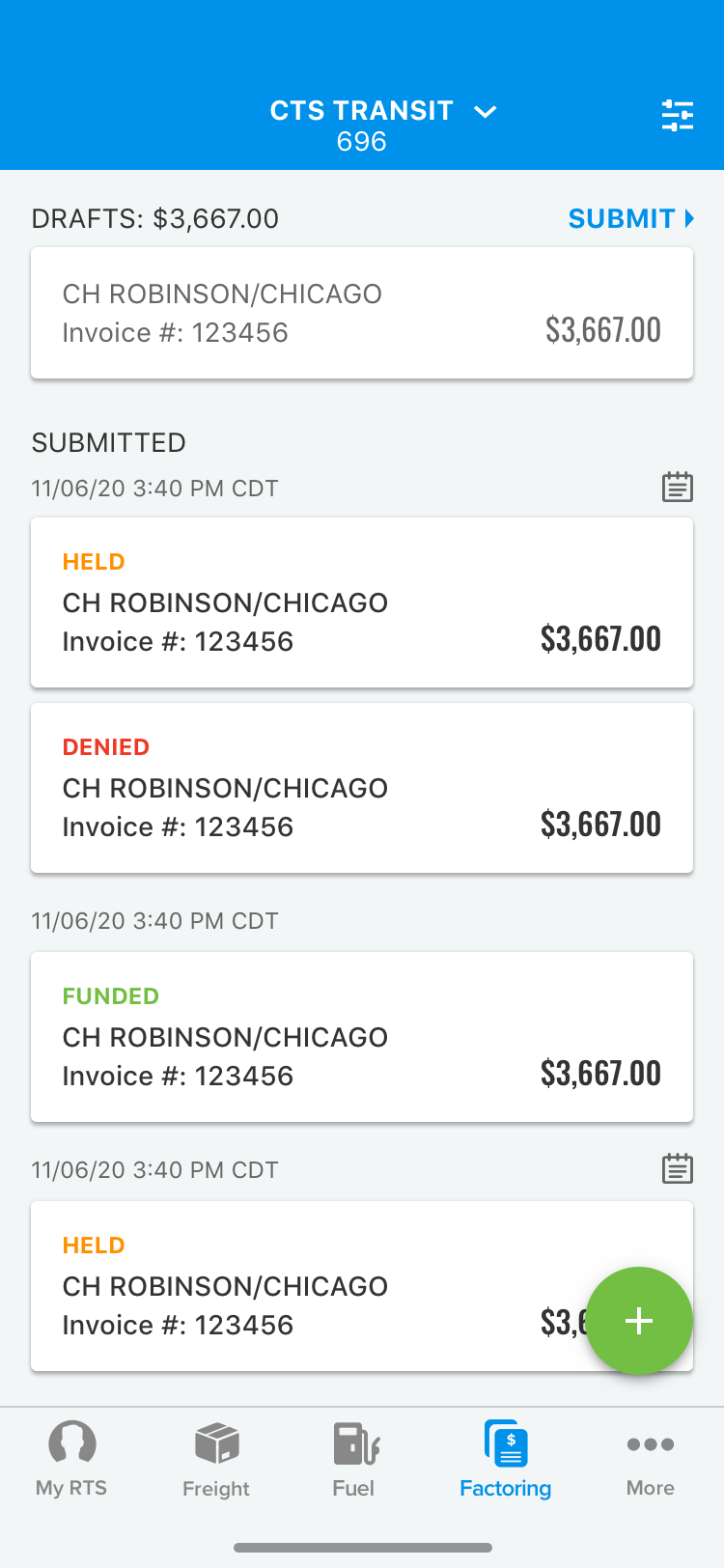

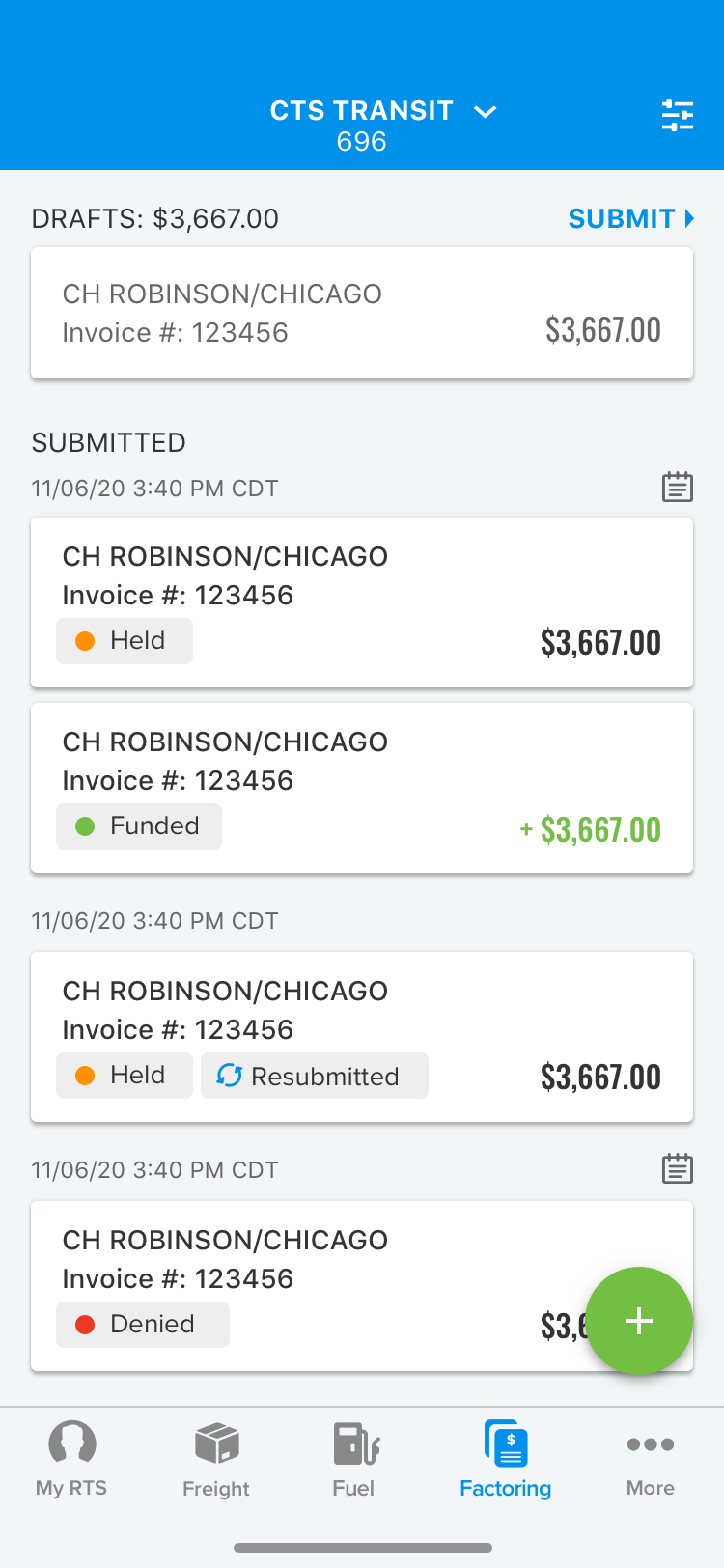

I worked through design concepts to communicate invoice statuses on mobile. Even though this project was only focused on held invoices, I wanted to plan for future status enhancements, including denied and funded.

![]()

![]()

![]()

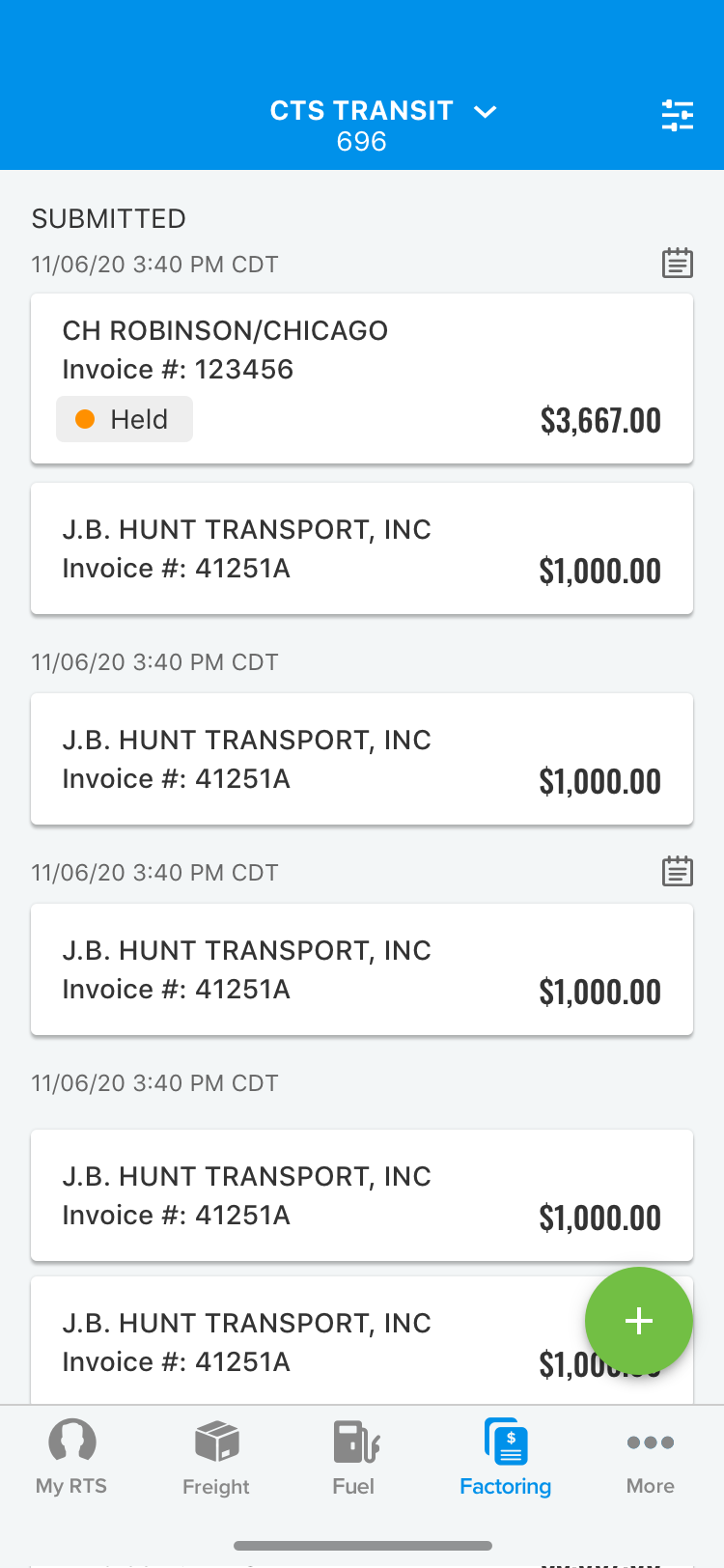

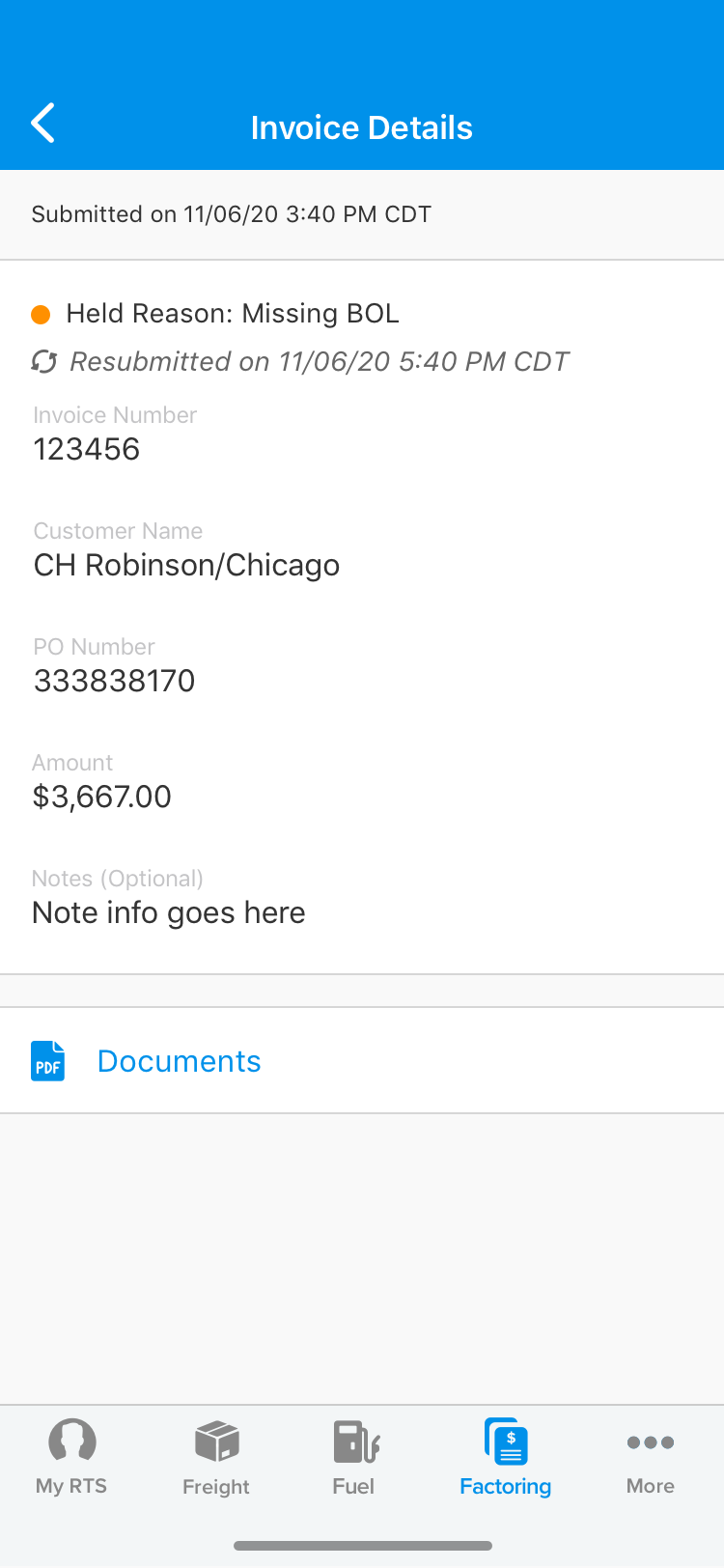

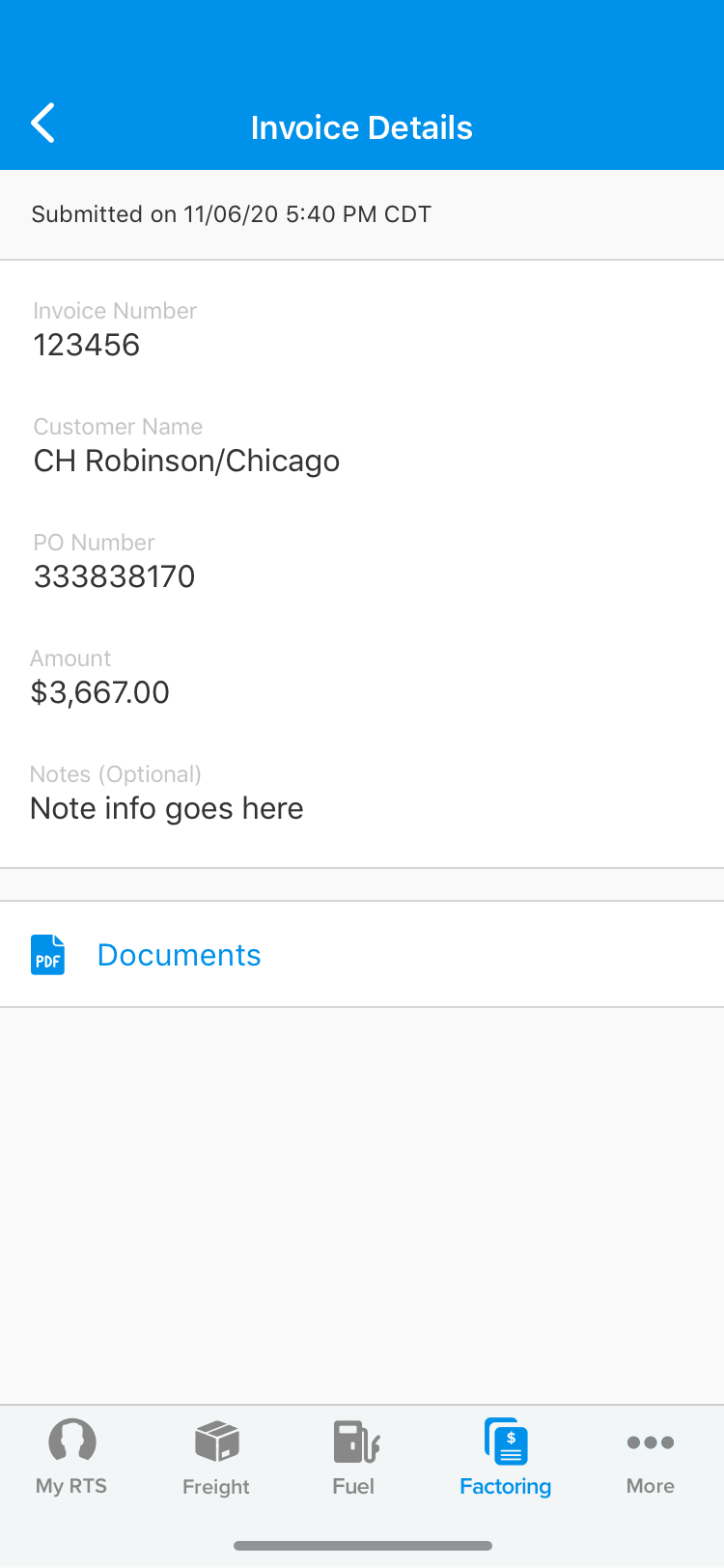

We determined the held status should persist on the invoice to provide an accurate record, but we also wanted to convey whether or not a held invoice had been resubmitted.

I refined the design direction and prepared end-to-end visuals for upcoming conversations with development.

![Held invoice appears in list]()

![View held invoice details]()

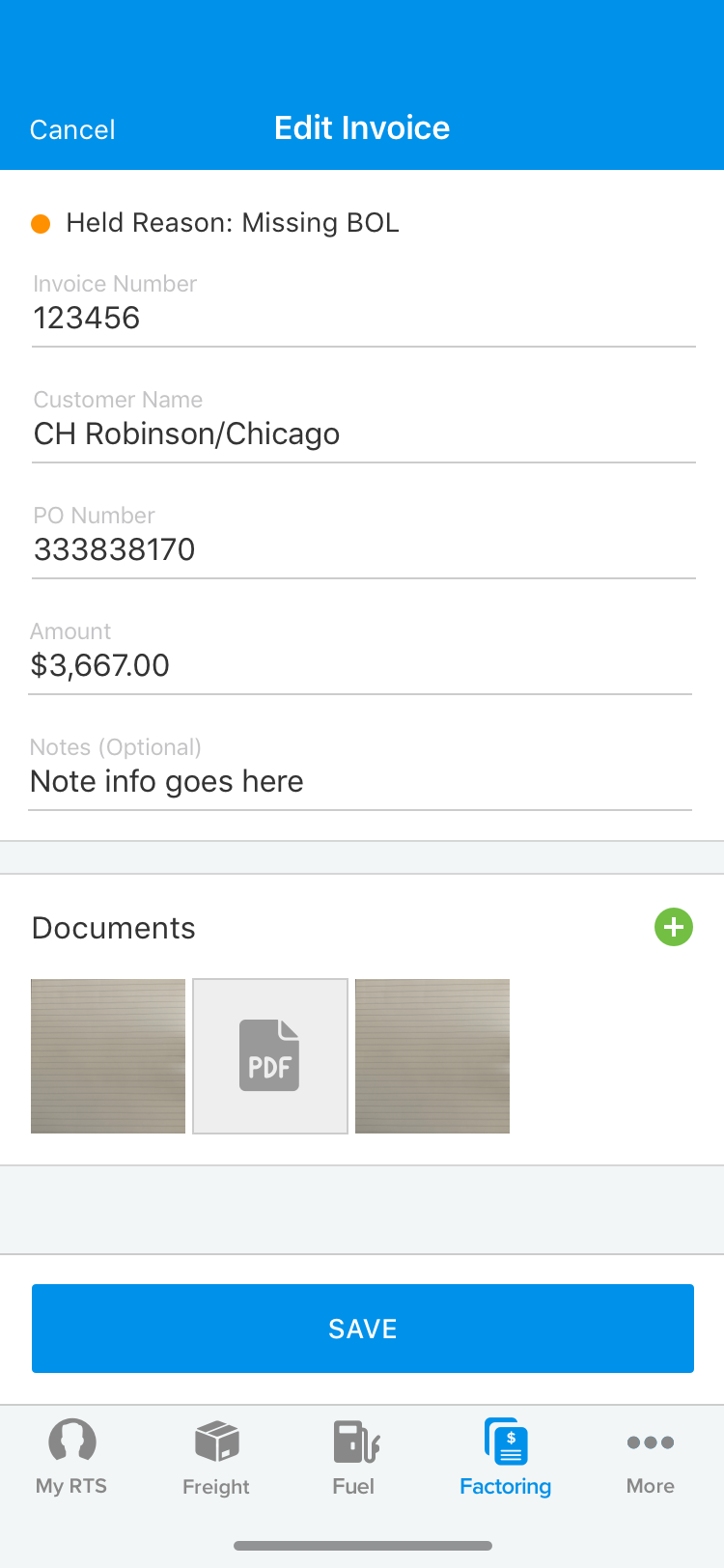

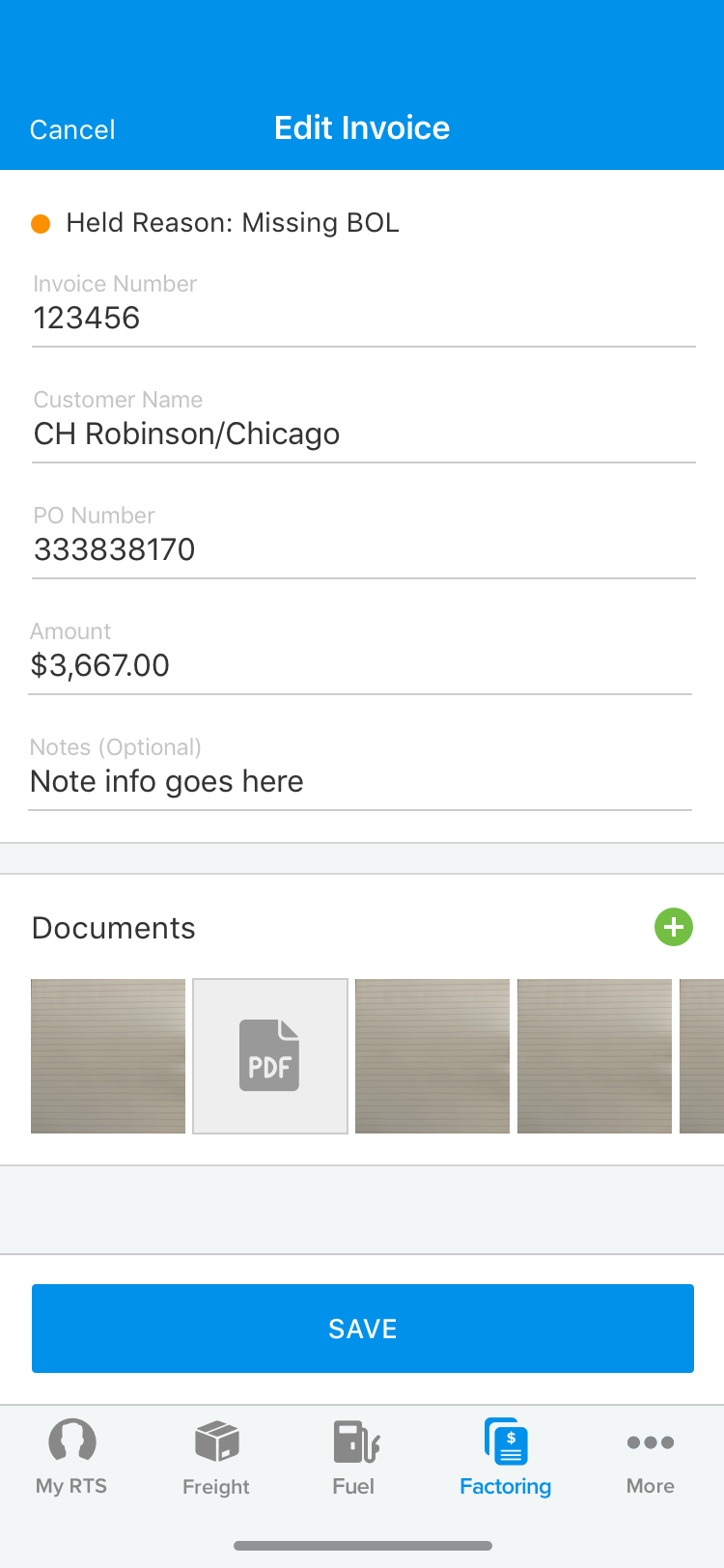

![Edit held invoice]()

![Add missing paperwork]()

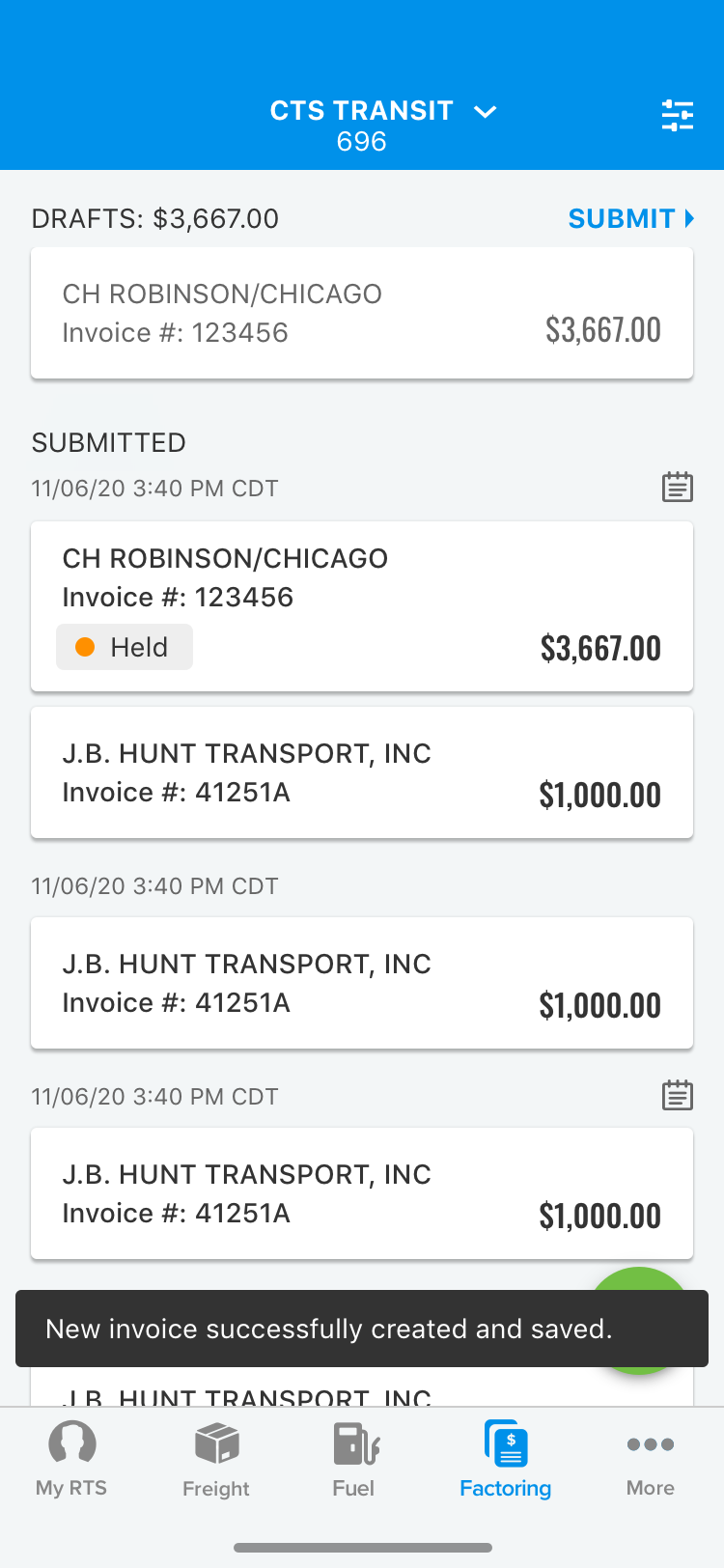

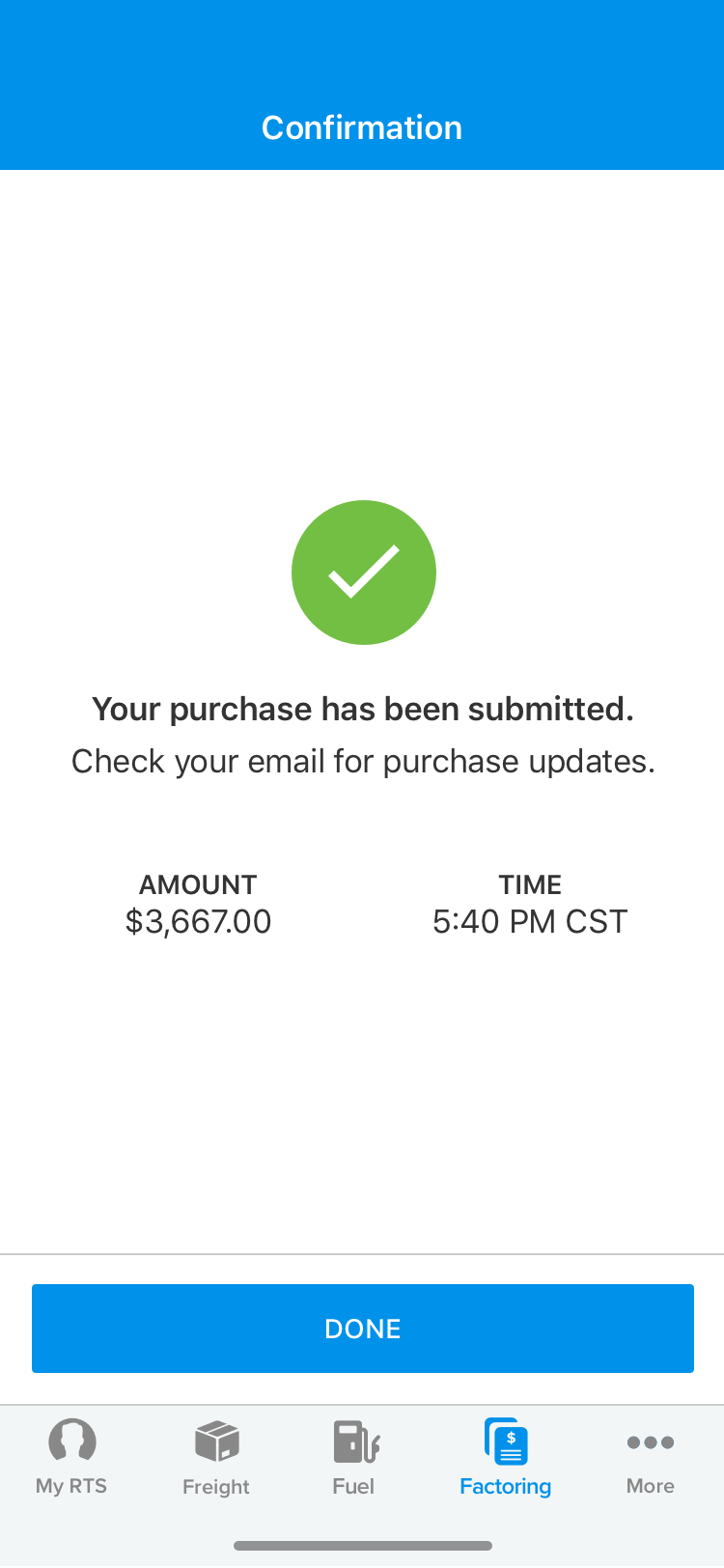

![Save new invoice]()

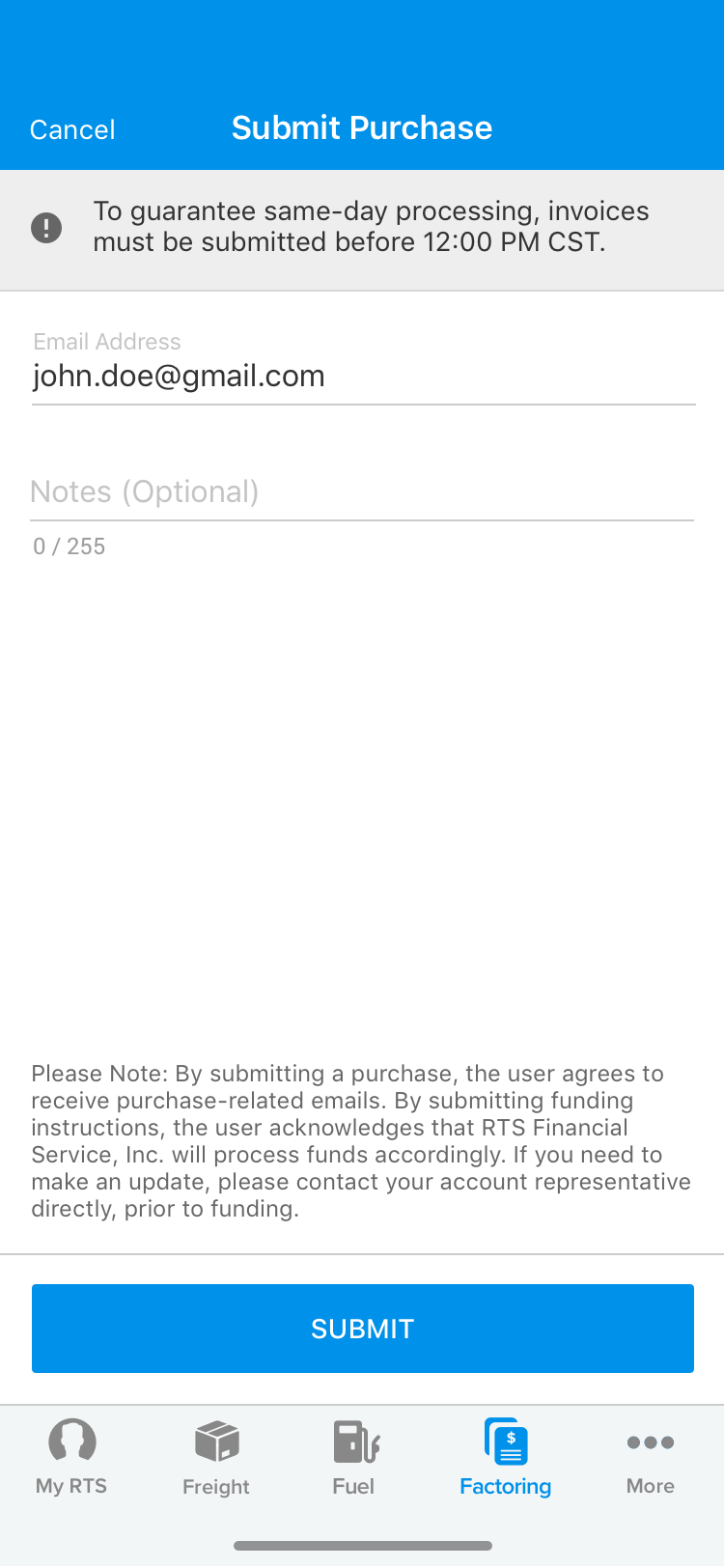

![Submit new invoice]()

![New invoice submitted]()

![New invoice appears in list]()

![View original held invoice details]()

![View new invoice details]()

Once the design was finalized, we had a breakout for the project epic, focusing on the mobile enhancements first. I walked through the prototype, the team asked questions, and we discussed what stories needed to be created. Once stories were defined, we also wrote acceptance criteria as a team.Shamrock Trading Corporation is a parent company for transportation, finance, and technology services. One of the financial services Shamrock offers is factoring, which means Shamrock will buy invoices from truck drivers so they get paid in 1-2 days instead of the typical 60-90 days from the company they hauled for. These invoices must be audited by Shamrock account representatives before purchasing.

During invoice audits, reps will sometimes flag an invoice, signifying it cannot be purchased due to an issue. For example, if an invoice has bad quality documents attached or is missing certain documents it would be flagged. The current process is very manual and requires the reps to reach out to the customer to explain the issue and try to resolve it.

Project goals

- Give customers visibility to invoice issues in RTS Pro, the web and mobile application for Shamrock customers.

- Provide a way for customers to resolve invoice issues themselves.

- Reduce email and call volume for internal reps.

Process

To begin this process, we had a kickoff meeting with the product squad and business stakeholders to review project goals, discuss the current process, and brainstorm on initial requirements. After the meeting, I created a Miro board outlining the user flow, decision points, and functionality to ensure all parties were on the same page and approved of the path forward.

Not all customer account teams handle audits the same way, making the initial scope of this project more complicated. Depending on the customer, auditors will either allow time for fixes or just flag the invoice and move on to the next audit. Larger customers that submit a high volume of invoices (and generate significant revenue) are usually given the chance to fix issues before auditors submit their purchase for funding. Smaller customers do not get that opportunity and have to create a new invoice submission to be re-audited and (hopefully) funded.

Therefore, we had two user flows branching off from the internal audit process:

- Allowing customers to make updates to an in-progress invoice audit

- Not allowing updates and requiring a new submission

After reviewing the flows with the UX team, I started to wonder whether we were overcomplicating the current same-day processing flow and unnecessarily duplicating functionality in the app.

The Product Owner ultimately agreed and mentioned that larger customers probably won’t change their behavior and will expect to still go through their rep to fix issues. We worried this would be wasted functionality as the immediate value was in making it easier for smaller customers (often doing business on their phones) to resubmit flagged invoices.

We regrouped with the business stakeholders to vet this decision as well. They agreed and we discussed what terminology reps use with customers to communicate flagged invoices. We learned:

- “Denied” means we will never purchase the invoice

- “On hold” or “Held” means we rejected the invoice but would consider purchasing it in a future submission if updates are made

After these discussions, we refocused our efforts on the mobile experience for smaller customers who would need to resubmit their invoices.

I conducted some mobile competitive analysis and sketched some initial concepts.

I worked through design concepts to communicate invoice statuses on mobile. Even though this project was only focused on held invoices, I wanted to plan for future status enhancements, including denied and funded.

We determined the held status should persist on the invoice to provide an accurate record, but we also wanted to convey whether or not a held invoice had been resubmitted.

I refined the design direction and prepared end-to-end visuals for upcoming conversations with development.

Throughout development, there was a lot of back-and-forth discussion and testing to ensure things were looking and functioning as expected.

As we neared the end of development, we collaborated with the marketing team and helped create an email to customers communicating this change. I provided the following bullet points highlighting the benefits of this change to help inform the email content.

Customers now can:

-

Understand which invoices have been held during an audit and why.

-

Easily edit and resubmit held invoices in the next purchase. We save and transfer all data so they don’t have to retype information or reattach documents.

- Stay organized by seeing which held invoices have been resubmitted and when.

Outcomes

- The feature was well-received as a very intuitive design. Even without the scheduled marketing push, users discovered it and used it without issue.

- 83 invoices were resubmitted through the new process in one day without any formal communication to clients about the change.

- 200 invoices were resubmitted the following day.

- 2 weeks after launch, we hit 5000 resubmit events.

- 4 weeks after launch, we hit 8800 resubmit events.

- 12 weeks after launch, we hit 29,103 resubmit events across 5,566 companies. For reference, there are about 14,000 companies using the factoring service.

- Internal reps called this feature a “game-changer”. It has saved them a lot of time returning customer phone calls or emails.